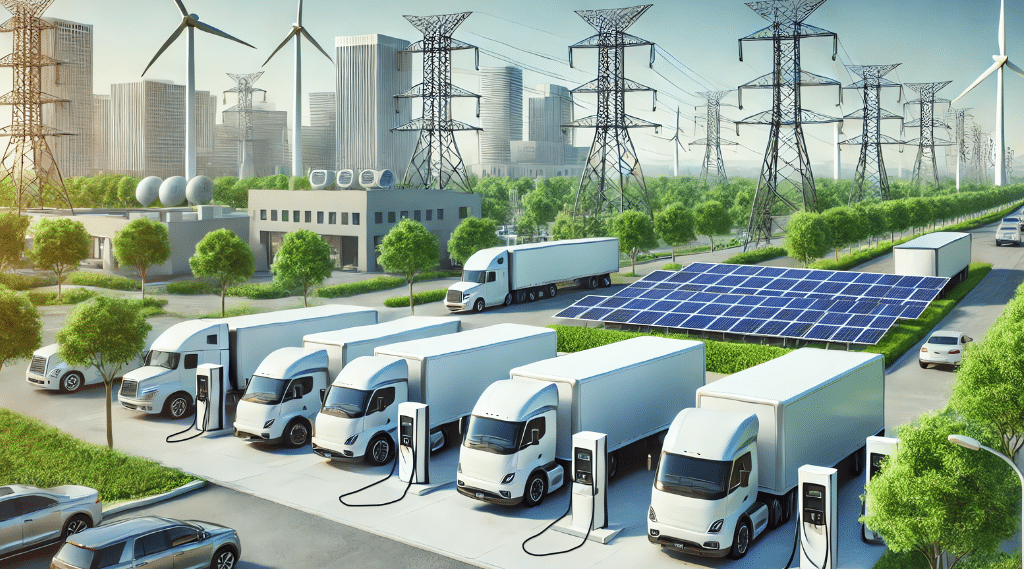

The transition of the United States to Electric Vehicle (EV)-powered transportation raises a vital question: Can our electric grid, including utilities, municipal systems, and independent system operators, handle the projected electrification demands?

Many anticipate that the grid will struggle with the additional demand projected from various forms of electrification. This growing demand encompasses not only EVs but also power-hungry Information Age infrastructure, including data centers, AI implementations, and cryptocurrency mining. Additional stressors include increased manufacturing, hydrogen fuel production for new emission-free vehicles, transitioning residential and commercial appliances from natural gas to electricity, and severe weather patterns.

Understanding how different types of electrification demands impact the grid and the challenges they create is crucial for infrastructure planning and funding by governments and private industry. Notably, EV fleet electrification may be the most “grid-friendly” load to support.

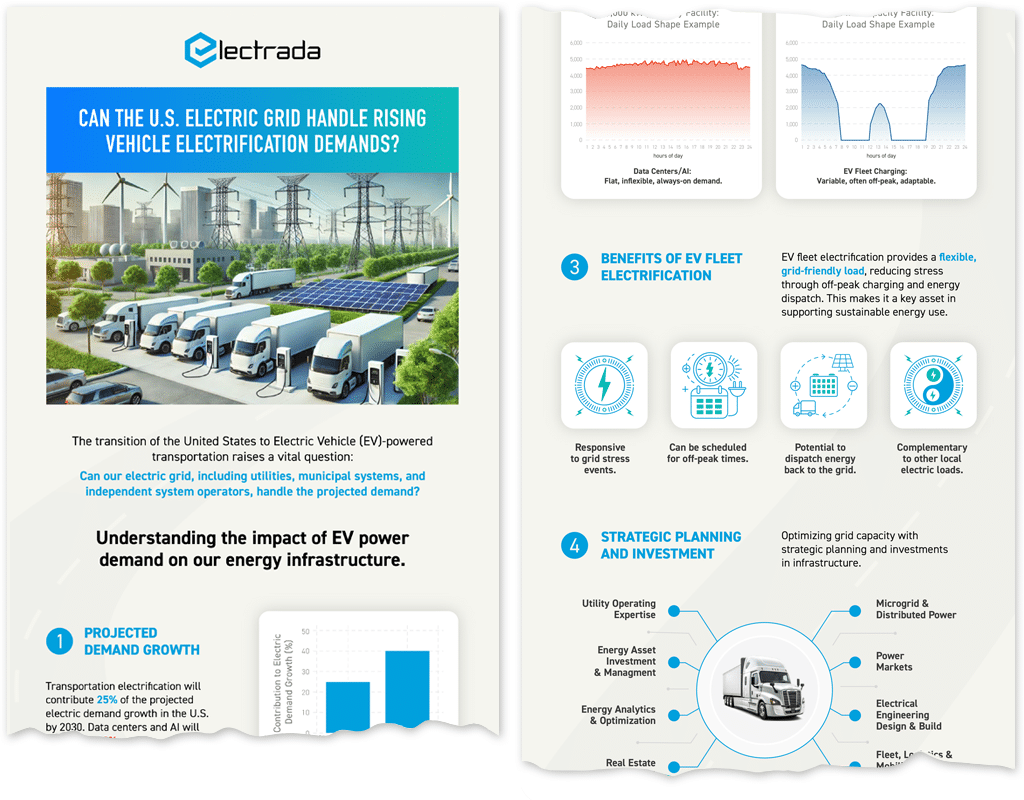

Comparing Electrification Demands and Their Grid Impact

Overall, grid stress results from both projected load and its dynamic nature. According to Goldman Sachs (April 2024), transportation electrification is expected to contribute 25% to the overall growth of electric demand in the U.S. by 2030, compared to 40% attributed to data centers and AI. Specifically, every 5% penetration of commercial fleet electrification adds approximately 110,000 MWh of new load (0.8% of average daily U.S. electric demand).

There are significant differences, however, in how these electrification demands impact the grid. For data centers and AI, the load is relatively flat, inflexible, and “always on.” A 5MW power capacity demand is nearly constant, necessitating substantial transmission upgrades and additional electricity generation.

In contrast, EV fleet charging demand is variable and often occurs at off-peak times (see chart below). A 5MW fleet capacity requirement may primarily be scheduled for overnight charging or shifted outside of peak times through on-site battery dispatch or through charging management software. Battery-powered fleets also have the capacity, in collaboration with utilities, to be responsive to grid stress events or locational price spikes by granularly “shaping” their power requirements or even dispatching energy back.

Why Fleet EV Charging is a Smarter Electrification Demand

Consequently, increasing data center load, which has driven growing electrification demands in many states, requires significant investments in transmission upgrades and new electricity generation, leading to regional power capacity planning challenges and higher costs. In contrast, fleet EV charging demand profiles and depot load can be designed to complement projected grid capacity, particularly at critical infrastructure stress points such as industrial zones, ports, and logistics hubs.

Although this necessitates detailed planning at the substation and distribution levels, it can often be accommodated incrementally, without substantial grid updates.

Conclusion: Managing Electrification Demands for a Resilient Grid

Understanding the nuances of different electrification demands is essential for optimizing the U.S. electric grid and the requisite billions of dollars of ratepayer and investor capital to be deployed in the coming years. Impressively, fleet electrification presents a more adaptable and less grid-intensive load than other areas of electricity demand growth, offering significant advantages for managing grid stress and reducing environmental impact compared to data centers and AI.

Explore More with Our Infographic